Simplify and streamline your company’s financial and treasury management with integrated apps for Business Central.

Get real-time, reliable data, minimize errors, and gain full control over every operation.

Optimize Every Accounting and Financial Activity with Finance and Treasury Apps

Simplify Accounting Flows, Enhance Visibility, and Accelerate Every Process

With the apps dedicated to financial and treasury administrative management for Business Central, you simplify accounting activities, automate processes and improve control over economic data. Here’s how each solution can support your operations.

Click to learn more about the topics:

- Accounting Automation and Administrative Management

- VAT, Withholding Tax, and Fiscal Compliance

- Invoicing and Sales/Purchase Cycles

- Accrual Accounting and Management Control

- Treasury and Real Estate Management

Accounting Automation and Administrative Management

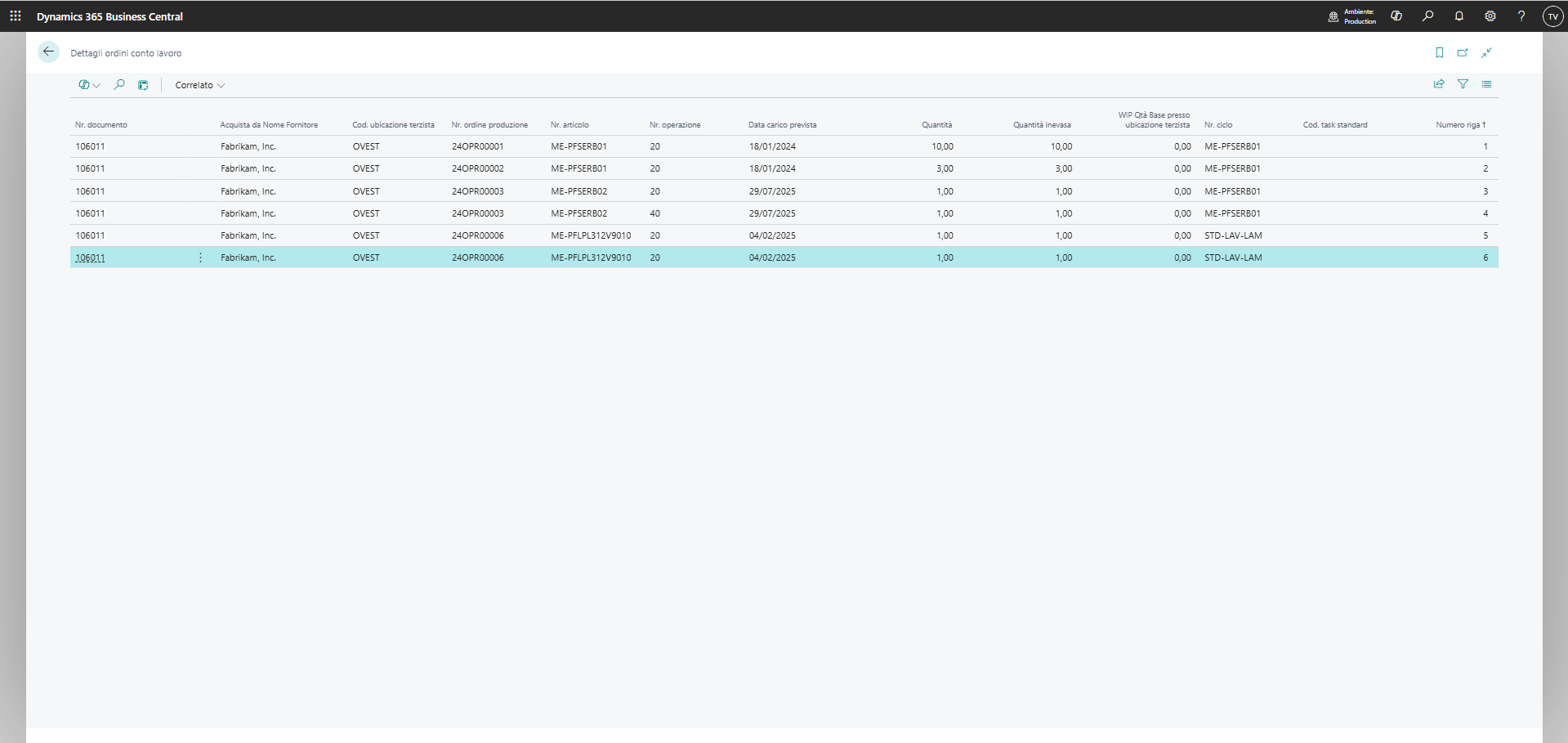

Due Date Splitting

- Advanced due date management: split a single accounting entry into multiple due dates within customer and vendor ledger entries, each with its own date and payment method.

- Automatic line generation: the system automatically creates as many lines as there are due dates, maintaining the same document number.

- Greater operational flexibility: splitting allows more agile due date management compared to the standard.

Customer/Vendor Offsetting

- Cross-postings for dual-role entities: automatically manage offsetting for those acting as both customers and vendors.

- Efficient open item closure: streamline accounting with automatic suggestions for offsetting related entries.

Open Item Management

- Linking entries for the same account: automatically match internal accounting entries related to the same account.

- Instant residual amount calculation: quickly view outstanding balances.

- Extended open item logic: apply open item logic beyond customers and vendors, maintaining consistency in links and balances.

Custom Customer and Vendor Aging Reports

- Advanced dedicated reports: access four custom reports—two for customers and two for vendors—not available in standard Business Central.

- Retroactive inquiry: set a past date to verify whether a document was open at that specific point in time.

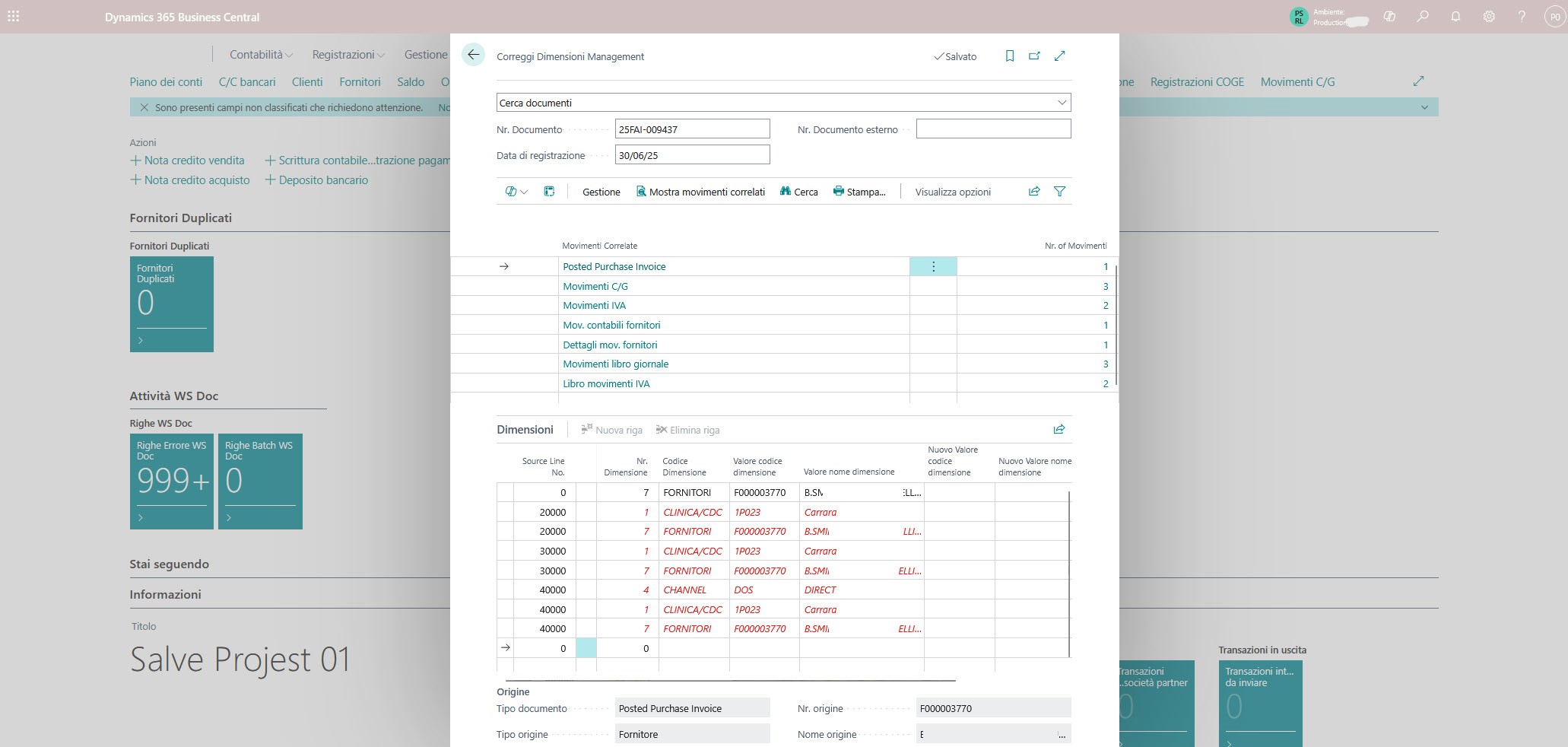

Registered Document Editing Tool

- Post-posting corrections: edit or delete invoices, credit notes, and general ledger entries unless the document is within a closed VAT period or involves moved items.

- Greater operational autonomy: allow administrative users to correct critical errors directly in registered documents, avoiding reversal entries.

Mass Customer Entry Linking

- Automatic ledger entry closure: match customer entries using a report on the Customer Ledger Entries table.

- Smart “same date” criterion: match more than two documents, optimizing open item management.

VAT, Withholding Tax, and Fiscal Compliance

VAT Prorata

- Automatic deductible percentage calculation: manage VAT using analytical or flat-rate methods in compliance with regulations.

- Annual or intra-annual prorata management: easily set the applicable prorata period.

VAT Exemption Plus – Letters of Intent

- Multiple exemptions handling: link multiple letters of intent to the same document.

- VAT ceiling monitoring: track the available and used ceiling per customer.

- XML trace compliance: automatically generate invoices with letter of intent number and date, if enabled.

VAT Reports – Settlement – Registers – Summary

- Comprehensive VAT management reports: generate VAT registers, periodic settlements, and summary statements, with a reprint feature always available.

- Optimized layouts for readability: improved layouts over standard templates for faster accounting reconciliation.

VAT Settlement Reopening

- Autonomous management of closed settlements: reopen already posted VAT settlements without technical support.

- Regulatory compliance: reopen only the most recent closed settlement, complying with current fiscal rules.

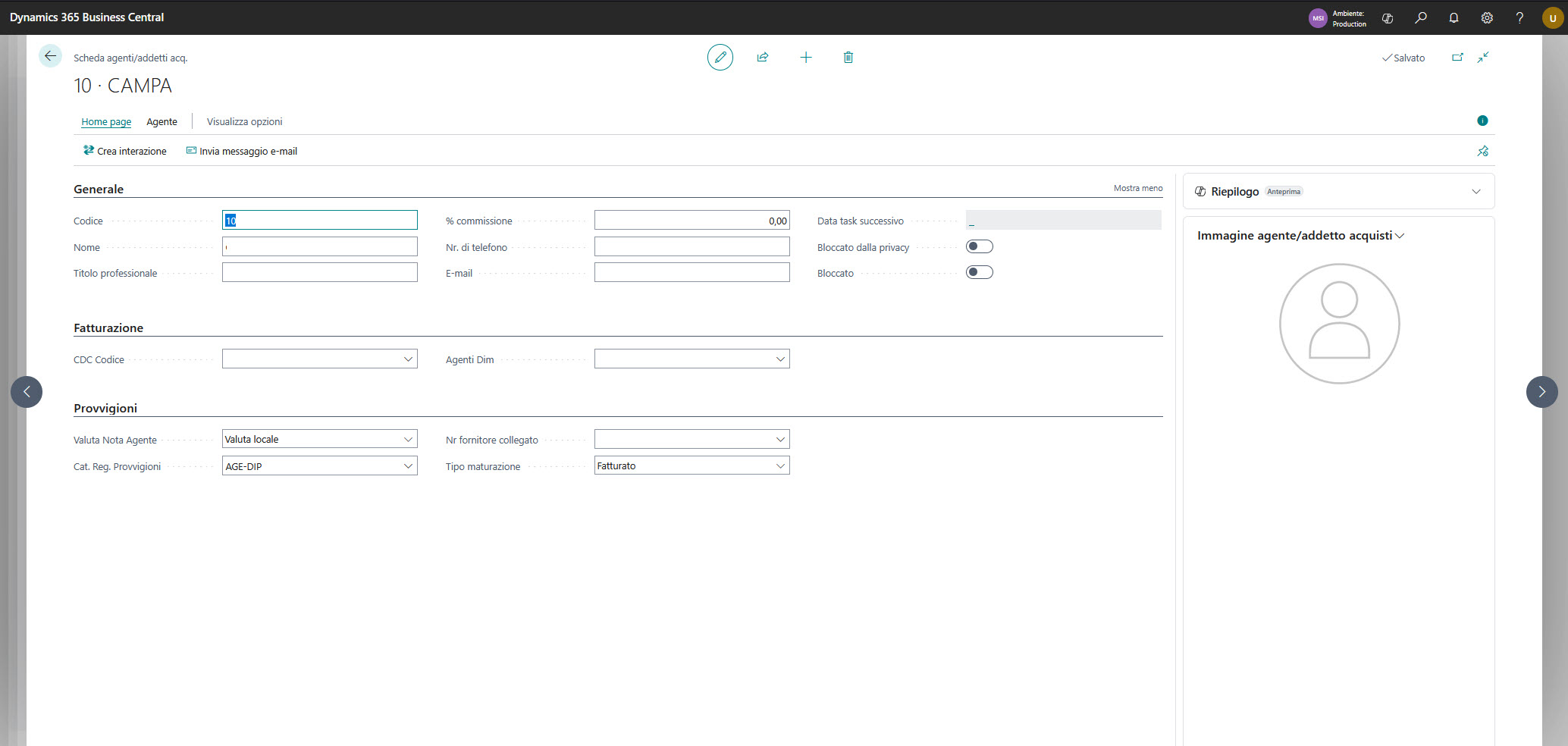

Active Withholding Tax

- Automated sales withholding: apply withholding tax to sales invoices.

- Electronic invoicing integration: automatically include withholding tax details in XML invoice files.

Management of INPS withholdings

- Automated sales withholding: apply withholding tax to sales invoices.

- Electronic invoicing integration: automatically include withholding tax details in XML invoice files.

Social Security Contributions – CPA

- Withholding integration: calculate CPA and withholding taxes in a single accounting flow.

- Social security fund management: add CPA contributions to invoicing for professionals not subject to withholding tax.

- Stronger regulatory alignment: ensure full compliance with tax and social security regulations.

CONAI Management

- Automated CONAI compliance: include CONAI contributions in shipping and goods receipt documents.

- Compliance control: ensure packaging operations meet current regulations, integrating contributions accurately in tax documents.

Invoicing and Sales/Purchase Cycles

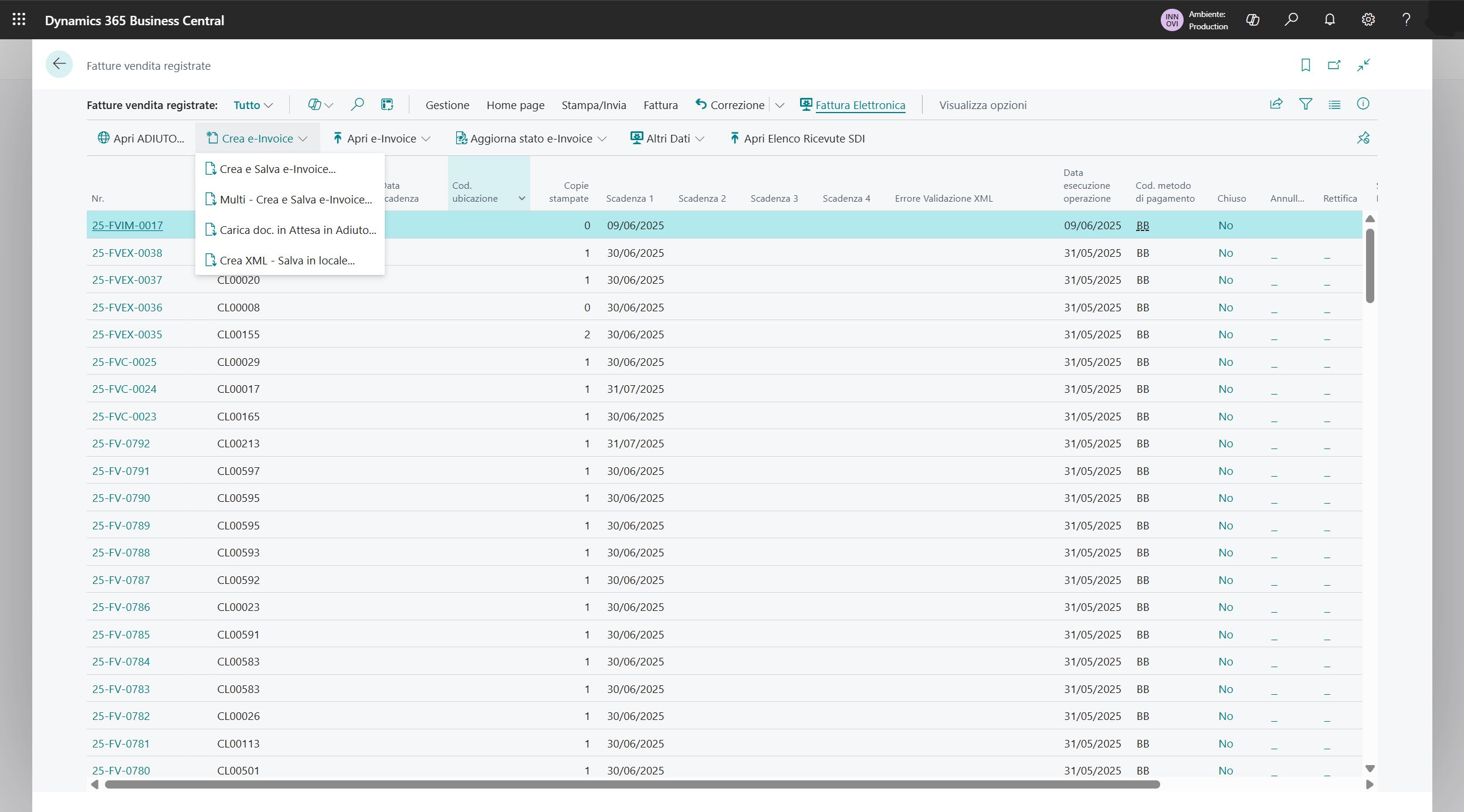

E-Invoicing – Adiuto/Aruba

- Automatic XML file generation: create e-invoice XML files according to required standards.

- Automatic upload: send invoices to document management systems with no manual steps.

Automatic purchase invoice receipt: import incoming invoices via SDI into the system automatically.

Advance Invoice Management

- Invoice advance handling: directly select the bank for advancing invoices.

- Operational time savings: streamline workflows without leaving Business Central.

Job-Based Mass Invoicing

- Automatic invoice generation: generate sales invoices from one or more job planning lines, centralizing management and reducing manual work.

Accrual Accounting and Management Control

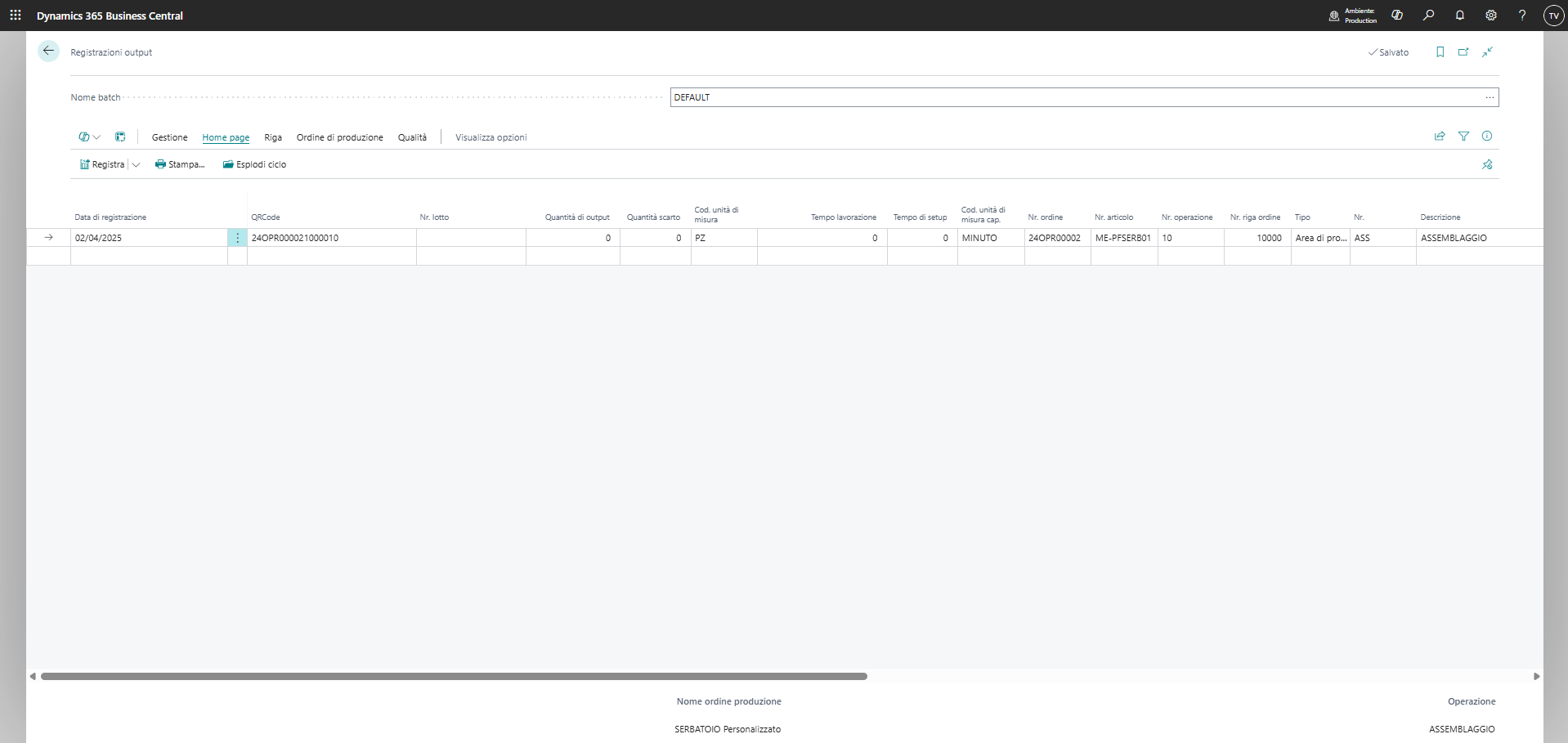

MCA – ExtraGL – Accrual Accounting

- Integrated accrual accounting: post costs and revenues per period in separate ledgers (ExtraGL). Accrual date on invoices and GL entries triggers automatic adjusting entries.

- “Simulated” closing entries: manage invoices to be received, asset depreciation, and other adjustments through temporary entries for timely analysis.

- Enhanced analytical accounting: view ExtraGL entries in standard analytical reports for a unified view of financial and accrual accounting.

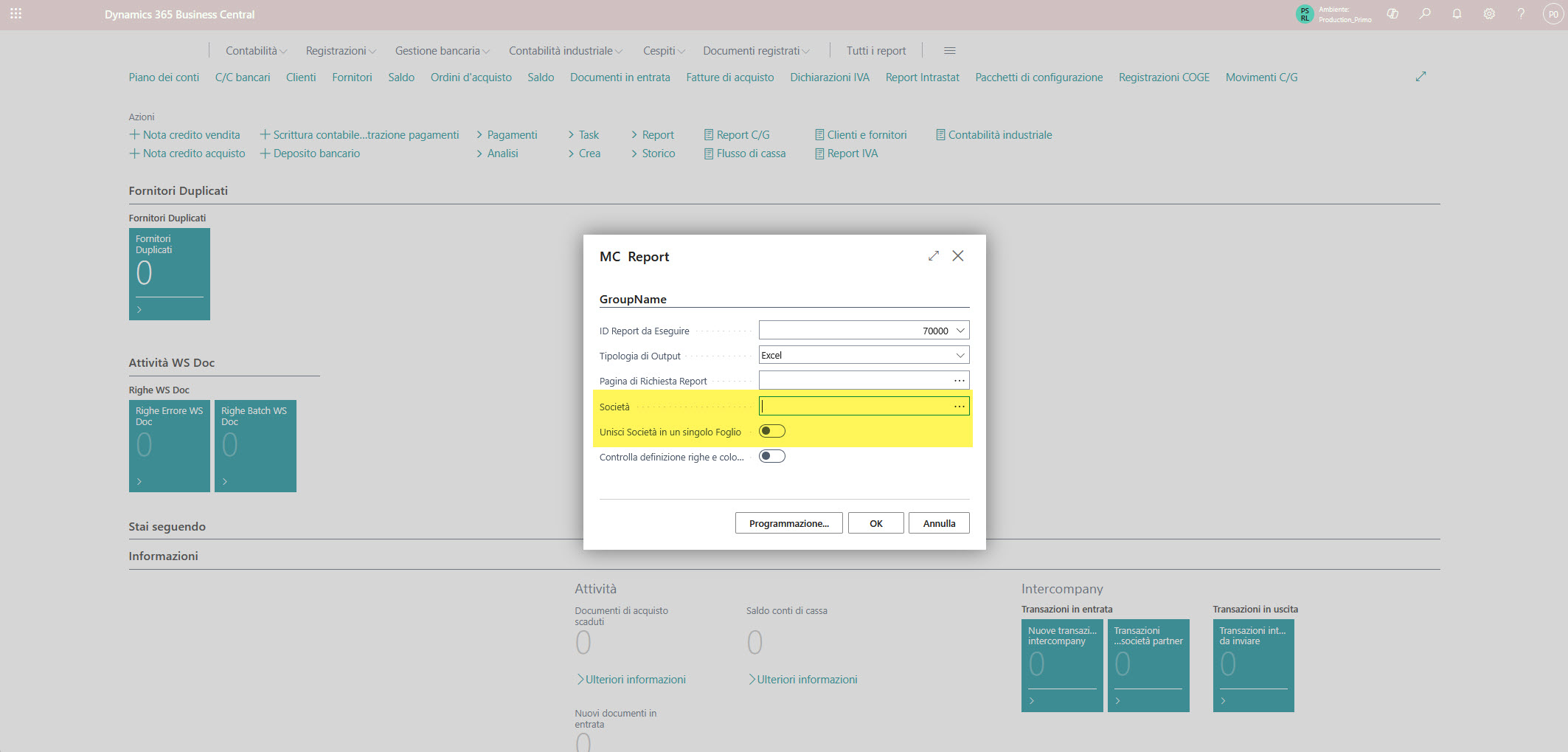

Fourth EU Directive

- Financial statement processing per IV EU Directive: generate files with current and previous year values.

- Accrual accounting compatibility: with MCA enabled, use ExtraGL entries to feed the European balance sheet automatically.

Accounting Report Consistency Check

- Detect posted but missing accounts: quickly identify active accounts not included in accounting reports.

- Duplicate account control: find duplicate accounts in the same report, regardless of dimension filters.

- Easier administrative control: improve reliability and accuracy in periodic accounting checks.

Opposed Sections Balance Sheet

- Generate and view opposed sections financial statements: print a trial balance with an alternative layout from Business Central, showing Assets/Liabilities and Costs/Revenues in separate sections.

Treasury and Real Estate Management

DocFinance – Integration

- ERP and treasury integration: link Business Central with DocFinance for seamless treasury management.

- Bidirectional data exchange: export master data, chart of accounts, customers, vendors, banks, and due dates; import payments made from DocFinance.

Real Estate Management – Jobs

- Centralized real estate management: create a separate job for each property.

- ISTAT, deposits, and rental management: calculate ISTAT adjustments, manage deposits (including interest-bearing ones), registration taxes, and monitor rent payments.

- Complete cost and revenue analysis per property: track financial performance of each individual job.

Bank Integration

- SEPA and CBI compliance: update banking layouts to the latest CBI technical specs.

- Secure transmission of banking flows: ensure compliant and secure transmission of bank data, minimizing errors.

Cerved

- Export data in Cerved format: generate master data and accounting movement files formatted for Cerved.

- Compliance with official layouts: adhere to Cerved’s technical specifications to avoid formatting errors.

With Innovio and Business Central Finance Apps, Financial Management Becomes a Competitive Edge

From general accounting to VAT, treasury, and reporting—paired with the right apps and expert guidance—every process becomes simpler, more accurate, and traceable.

At Innovio, we assist you through every step: from needs analysis to app configuration and full integration in Business Central. This means smoother workflows, fewer errors, and complete control over your finances.

Your Questions Answered – FAQs on Treasury Apps for Business Central

We provide personalized consulting to identify the best finance and treasury apps based on your workflows and business goals.

Are these apps hard to integrate into Business Central?

No. All apps are designed to natively integrate with Microsoft Dynamics 365 Business Central.

Can the apps be customized for specific needs?

Yes. We tailor apps or build custom features to suit your operations perfectly.

Can I manage withholdings and pension funds automatically?

Yes. Apps for withholdings and CPA automate tax calculations and integrate them into electronic invoices.

Is prorated VAT supported?

Absolutely. The VAT Prorata app calculates deduction percentages and ensures regulatory compliance.

Can I record accruals and deferrals not supported by standard BC?

Yes. With MCA, you can manage off-ledger accrual accounting entries.

Is there a faster way to reconcile between customers and suppliers?

Some apps enable quick reconciliations and inter-party offsetting with a single action.

Can I manage invoice advances directly in Business Central?

Yes. The Advance Invoice Management app allows you to select the bank and track everything within BC.

Can I generate IV EU-compliant balance sheets?

Yes. A dedicated app produces compliant balance sheets, even integrating ExtraCoGe entries.

Other products that may interest you

Want to know more?

Get in touch with our professionals.

Our customer support team is ready to provide all the answers you need.

"*" indicates required fields